:max_bytes(150000):strip_icc()/thinkstockphotos-177795210-5bfc35294cedfd0026c2df84.jpg)

A investment advisory firm business plan should include a three-year to five-year profit and loss statement, cash flow analysis, balance sheet, breakeven analysis, and business ratios page. Very important within the business planning document is a complete overview of the target demographics and local market that will be served through this business Provide a high-level explanation of the financial services landscape in the United States and current market trends as they impact financial advisors. Elaborate on your local market as well. Describe customer segmentation in terms of demographics, geographical spread and wealth characteristics. Explain market needs from the customers’ blogger.com: blogger.com Dec 31, · The One-Page Business Plan Template for Financial Advisors. There is brilliance in simplicity. Ask financial advisors if business planning is important, and most will say, “yes, of course Estimated Reading Time: 4 mins

Financial Advisor Business Plan Sample [] | OGScapital

Investment Advisory Firm Business Plan, Marketing Plan, How To Guide, and Funding Directory. The Investment Advisory Firm Business Plan and Business Development toolkit features 18 different documents that you can use for capital raising or general business planning purposes. Our product line also features comprehensive information regarding to how to start an Investment Advisory Firm business. All business planning packages come with easy-to-use instructions so that you can reduce the time needed to create a professional business plan and presentation.

Your Business Planning Package will be immediately emailed to you after you make your purchase. Investment advisory firms generate highly recurring streams of revenue registered investment advisor business plan providing ongoing asset management services to their clients. There are some firms that operate strictly any fee-for-service only capacity where the yearly fee is a flat rate.

Many investment advisory firms frequently will offer clients both types of payment plans. Usually, for higher registered investment advisor business plan worth individuals the fee registered investment advisor business plan fixed given that the amount of work necessary does not necessarily need to correlate to a much more substantial ongoing yearly fee.

The startup costs that are associated with a new investment advisory firm are relatively low. These costs maybe higher if the individual decides to operate as a full scale registered investment advisory firm as well as a broker dealer. However, most individuals will start their company as a registered advisory registered investment advisory firm only. Most financial institutions will not provide the initial capital needed in order to start an investment advisory business.

This is due to the fact that there are a number of laws pertaining to how these companies can be financed. However, a working capital line of credit secured by an existing asset such as a piece of real estate can be acquired in order to start this type of business.

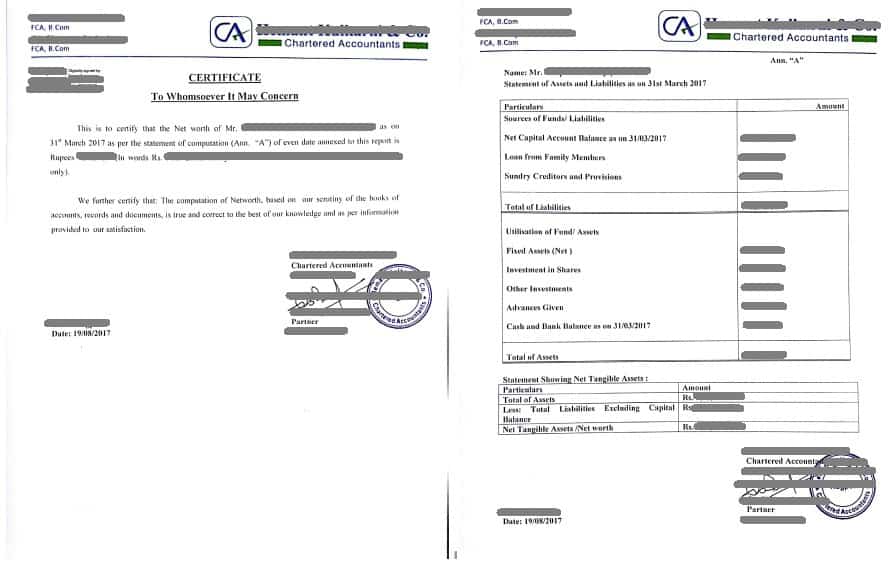

For individuals that are extremely qualified investment managers, many private investors are willing to put up the necessary capital in order to assist registered investment advisor business plan individual with launching their own registered investment advisory firm. A investment advisory firm business plan should include a three-year to five-year profit and loss statement, cash flow analysis, balance sheet, breakeven analysis, and business ratios page. Very important within the business planning document is a complete overview of the target demographics and local market that will be served through this business.

Most importantly, an examination of the average net worth of individuals within the target market should be thoroughly examined. Other factors to consider when developing the demographic analysis is median household income, median family income, average household net worth, population size, population density, and the number of competitors operating within the market.

As it relates registered investment advisor business plan competition — a new investment advisory firm will face competition from affiliated brokerages and advisers as well as independent companies.

Every competitor within a 50 mile radius should be examined. An investment advisory firm marketing plan is imperative. The highly recurring streams of revenue generated from managing assets drives a substantial amount of competition into this market. As such, it is extremely important that the investment advisor develop a strong differentiating factor as it relates to obtaining clients.

Many RIA firms will frequently have their advisors host seminars that are open to the general public in order to develop ongoing relationships with higher net worth individuals that have a significant amount of investable assets. A presence on the Internet is also extremely important given that many people will now find local services — such as investment advisers — online.

This proprietary website should showcase the costs relating to services as well as the biographies of all investment advisors on staff. A presence on social media is also important but not imperative for a new investment advisory firm. Beyond the business plan and marketing plan, most individuals will also develop an investment advisory firm SWOT analysis.

Relating to strengths, these companies are able to generate highly recurring streams of revenue from their services. The barriers to entry for new investment advisory firm all are also very high. For weaknesses, this is an extremely competitive industry that faces a lot of regulatory push on a day-to-day basis.

As such, a substantial portion of an entrepreneur is time is going to be spent complying with the myriad of laws relating to asset management and securities trading, registered investment advisor business plan.

For opportunities, this business benefits significantly from economies of scale in that once a client is enrolled there really no major additional costs relating to providing the services. Additionally, many investment advisory firms will hire associated advisors that will work with the business on a contractual or employment basis.

In closing, and investment advisory firm is a great businesses start provided that the individual has a complete understanding of finance and all of the necessary licensure in place. Although these businesses are very difficult start, once established these can be highly lucrative and highly profitable businesses, registered investment advisor business plan.

Skip to content Investment Advisory Firm Business Plan, Marketing Plan, How To Guide, registered investment advisor business plan, and Funding Directory The Investment Advisory Firm Business Plan and Business Development toolkit features 18 different documents that you can use for capital raising or general business planning purposes. Revenues and Expenses Input Page. Profit and loss Statement. Loan Amortization Table, registered investment advisor business plan.

Financial Advisor Business Plan

, time: 1:54A Financial Advisor Business Plan Template You'll Want to Use

A investment advisory firm business plan should include a three-year to five-year profit and loss statement, cash flow analysis, balance sheet, breakeven analysis, and business ratios page. Very important within the business planning document is a complete overview of the target demographics and local market that will be served through this business Dec 31, · The One-Page Business Plan Template for Financial Advisors. There is brilliance in simplicity. Ask financial advisors if business planning is important, and most will say, “yes, of course Estimated Reading Time: 4 mins Aug 17, · Accordingly, for most financial advisors trying to figure out how to write a business plan, I’m an advocate of crafting a form of “one-page business plan” that captures the essential elements of the business, and provides direction about where to focus, especially focus the time of the advisor-owner in particular. In other words, the purpose for a financial advisor Estimated Reading Time: 10 mins

No comments:

Post a Comment